Meydan Free Zone Company Setup in Dubai

Are you an entrepreneur, startup founder, or international investor looking to establish a business presence in Dubai? Meydan Free Zone Company Setup Dubai offers a streamlined, cost-effective, and investor-friendly pathway to launching your business in one of the world’s most dynamic economies. This comprehensive guide walks you through every aspect of Meydan Free Zone company formation, from licensing requirements and setup costs to visa options and ongoing compliance.

Whether you’re a first-time business owner in the UAE or an experienced investor expanding operations, understanding the Meydan Free Zone business setup process is essential. EZ Bizz Corporate Services LLC, a Dubai-based business setup company, specializes in guiding clients through every step of free zone company formation, visas, corporate banking, and regulatory compliance.

Introduction to Meydan Free Zone:

Meydan Free Zone is a modern, business-friendly free zone located in the heart of Dubai’s prestigious Meydan district. Established to foster entrepreneurship and innovation, it has rapidly become a preferred destination for startups, SMEs, and international businesses seeking a foothold in the UAE market.

Strategic Location: Meydan Free Zone is strategically positioned near Dubai’s key commercial hubs, offering excellent connectivity to Dubai International Airport, Jebel Ali Port, and major business districts. This prime location enhances logistics efficiency and facilitates seamless business operations across the region.

Business Relevance in Dubai: As part of the Dubai business ecosystem, Meydan Free Zone supports diverse industries including technology, e-commerce, consulting, trading, media, education, and professional services. The free zone’s digital-first approach and simplified registration processes make it particularly attractive to modern businesses and digital nomads.

Attracting International Entrepreneurs: International investors in UAE find Meydan Free Zone appealing due to its 100% foreign ownership, zero corporate and income taxes, full repatriation of capital and profits, and the absence of mandatory physical office requirements. The free zone has positioned itself as a gateway for global entrepreneurs looking to access Middle Eastern, African, and Asian markets.

2. Why Choose Meydan Free Zone for Company Setup in Dubai

Choosing the right free zone is critical to your business success in the UAE. Meydan Free Zone Dubai stands out for several compelling reasons:

- Startup-Friendly Environment: Meydan offers flexible and affordable licensing packages specifically designed for entrepreneurs and small businesses. Unlike some traditional free zones, it caters to solo entrepreneurs, freelancers, and startups without imposing high capital requirements.

- Fast and Digital Incorporation: The Meydan Free Zone registration process is highly digitized, allowing applicants to complete most procedures online. From initial application to license issuance, the entire process can be completed in as little as 48 hours, making it one of the fastest free zones for Dubai free zone company setup.

- Cost-Effectiveness: Compared to other Dubai Free Zones, Meydan Free Zone license cost is competitive, especially for service-based and e-commerce businesses. The absence of mandatory physical office space requirements significantly reduces operational overhead.

- Wide Range of Business Activities: From consulting and trading to media production and e-commerce, Meydan supports over 2,000 business activities across multiple sectors. This flexibility allows businesses to select and combine activities under a single license.

- Access to Global Markets: Dubai’s strategic geographic position connects Meydan-based companies to over two billion consumers across the Middle East, Africa, and South Asia. UAE regulations and trade agreements facilitate smooth international business expansion.

3. Key Benefits of Meydan Free Zone Company Formation

Understanding the advantages of Meydan Free Zone company formation helps entrepreneurs make informed decisions:

- 100% Foreign Ownership: Foreign investors can own 100% of their business without requiring a local sponsor or partner. This complete ownership control is a major draw for international investors in UAE.

- Zero Tax Benefits: Companies in Meydan Free Zone enjoy 0% corporate tax, 0% personal income tax, and no import or export duties. These tax advantages significantly enhance profitability and cash flow.

- Full Repatriation of Capital and Profits: There are no restrictions on transferring 100% of your capital and profits abroad. Currency convertibility is guaranteed, ensuring smooth international financial operations.

- No Mandatory Physical Office: Unlike some traditional free zones, Meydan Free Zone does not mandate a physical office space for all license types. Flexible solutions like flexi-desk and virtual office packages reduce initial setup costs.

- Cost-Effective Licensing: With transparent pricing and customizable packages, the Meydan Free Zone license cost is affordable for startups and SMEs. The absence of hidden fees ensures budget predictability.

- Flexible Visa Options: Depending on your business activity and office package, you can secure investor visas, employee visas, and dependent visas. Meydan Free Zone visa allocations are scalable based on your workforce needs.

4. Business Activities & License Types in Meydan Free Zone

One of the strengths of Meydan Free Zone business setup is the wide array of activities and license types available. Understanding Meydan Free Zone license types helps you select the most suitable structure for your venture:

Commercial License

Ideal for trading businesses, import/export operations, and wholesale/retail activities. Commercial licenses cover a broad range of goods and commodities, enabling companies to conduct international trade seamlessly.

Professional / Service License

Suitable for consultants, advisors, IT services, marketing agencies, legal firms, and other professional service providers. This is the most popular license category for startups and freelancers offering knowledge-based services.

Media License

Designed for content creators, digital marketing agencies, media production houses, and publishing businesses. Media licenses grant permissions for creative and digital content activities.

Holding License

For companies whose primary activity is holding shares or assets in other companies. Holding licenses are suitable for investors managing multiple business ventures or investment portfolios.

Multi-Activity Allowance: Meydan Free Zone permits businesses to register multiple activities under a single license, providing operational flexibility. For instance, a consulting firm can also engage in trading or e-commerce without requiring separate licenses.

5. Meydan Free Zone Company Setup Requirements

To ensure a smooth Meydan Free Zone company formation process, it’s essential to understand the Meydan Free Zone requirements. Requirements vary slightly based on shareholder type:

For Individual Shareholders:

- Valid passport copy (minimum 6 months validity)

- UAE residence visa copy (if applicable)

- Passport-sized photographs (recent)

- Proof of address (utility bill or bank statement)

For Corporate Shareholders:

- Certificate of incorporation (apostilled and attested)

- Memorandum and Articles of Association (notarized)

- Board resolution authorizing company formation in UAE

- Certificate of good standing

- Passport copies of authorized signatories

Additional Documents: Depending on the business activity, additional approvals or documents may be required. EZ Bizz Corporate Services LLC assists clients in preparing complete documentation packages, ensuring compliance with UAE regulations and avoiding delays.

6. Step-by-Step Process to Register a Company in Meydan Free Zone

The Meydan Free Zone registration process is straightforward when you partner with experienced consultants like EZ Bizz Corporate Services LLC. Here’s a detailed breakdown:

Step 1: Activity Selection & Business Planning

The first step involves identifying your core business activities and determining the appropriate license type. EZ Bizz’s experienced business setup advisors conduct an in-depth consultation to understand your business model, target market, and operational needs. This ensures you select the right activities and avoid future licensing issues.

Step 2: Trade Name Reservation

Once activities are finalized, the next step is reserving your preferred trade name. Your business name must comply with UAE naming conventions and should not conflict with existing trademarks. EZ Bizz Corporate Services LLC handles name searches, approval submissions, and liaisons with Meydan Free Zone authorities.

Step 3: Documentation & Initial Approvals

Prepare and submit all required documents as outlined in the Meydan Free Zone requirements. EZ Bizz reviews all documents for accuracy, arranges attestation where needed, and ensures complete compliance with free zone regulations.

Step 4: License Issuance

After document verification and fee payment, Meydan Free Zone issues the business license. This typically takes 48 to 72 hours for standard applications. Your license grants legal authorization to conduct business in the free zone and internationally.

Step 5: Visa Processing

With the license in hand, the next step is processing investor and employee visas. EZ Bizz Corporate Services LLC manages the entire visa application process including medical tests, Emirates ID registration, and immigration clearances. Meydan Free Zone visa processing is efficient, with most visas issued within 5 to 10 business days.

Step 6: Bank Account Support

Opening a corporate bank account is critical for business operations. EZ Bizz leverages its banking relationships to facilitate smooth account opening with leading UAE banks. We assist with documentation, introductions, and follow-ups to ensure timely account activation.

7. Meydan Free Zone Company Setup Cost & Packages

Understanding the Meydan Free Zone license cost is essential for budgeting and financial planning. Costs vary based on license type, visa quota, and office requirements:

Typical License Cost Ranges:

- Freelance/Service License: Starting from AED 7,500 per year (for virtual office packages)

- Professional License: From AED 10,000 to AED 15,000 per year

- Commercial License: From AED 12,000 to AED 20,000 per year

- Media License: From AED 15,000 to AED 25,000 per year

Visa Package Options:

- 1 Visa Package: Suitable for solo entrepreneurs (AED 5,000 to AED 7,000 per visa)

- 3 Visa Package: Ideal for small teams (discounted per-visa rate)

- Custom Visa Packages: Scalable based on workforce requirements

Additional Government & Compliance Fees:

- Immigration card fees

- Medical fitness tests (approximately AED 300 per person)

- Emirates ID issuance fees (AED 270 per person)

- Notarization and attestation charges (if applicable)

- Consultancy service fees (varies by provider)

Sample Cost Table:

Item | Estimated Cost (AED) |

Professional License (Annual) | 10,000 – 15,000 |

Flexi-Desk Package | 3,000 – 5,000 |

Investor Visa (1 person) | 5,000 – 7,000 |

Government Fees (approx.) | 1,500 – 3,000 |

Total (Basic Package) | 19,500 – 30,000 |

Note: Costs are indicative and subject to change based on package selection and government fee updates. EZ Bizz Corporate Services LLC provides transparent pricing with no hidden charges, ensuring clients have complete visibility into their investment.

8. Visa Options & Residency Benefits

One of the major advantages of Meydan Free Zone company setup Dubai is the flexibility in visa allocation and residency benefits:

Investor Visas:

Business owners and shareholders are eligible for investor visas, allowing them to reside and work in the UAE. Investor visas are typically valid for 2 to 3 years and are renewable based on license validity.

Employee Visas:

Companies can sponsor employee visas for their workforce. The number of visas depends on the office package selected and the business activity. Meydan Free Zone visa quotas are scalable, allowing businesses to expand their teams as they grow.

Visa Quota Flexibility:

Unlike some free zones with strict visa caps, Meydan offers flexible visa allocations. Companies can request additional visa quotas by upgrading their office packages or demonstrating legitimate business needs.

Family Sponsorship:

Investors holding Meydan Free Zone visas can sponsor immediate family members (spouse and children) for residency visas, provided they meet minimum salary requirements as per UAE immigration rules. This makes Meydan an attractive option for entrepreneurs planning to relocate with their families.

9. Office Solutions & Corporate Bank Account

Flexi-Desk Options:

For startups and solo entrepreneurs, Meydan Free Zone offers cost-effective flexi-desk options. These packages include access to shared workspaces, meeting rooms, and business support services without the expense of dedicated office space.

Virtual Office & Dedicated Office Solutions:

Virtual offices provide a business address and mail handling services at minimal cost. For growing businesses requiring private space, Meydan offers customizable office solutions ranging from small private offices to larger suites.

Corporate Bank Account Assistance via EZ Bizz Corporate Services LLC:

Opening a corporate bank account in the UAE can be challenging due to strict compliance requirements. EZ Bizz Corporate Services LLC simplifies this process by:

- Preparing complete banking documentation

- Arranging introductions with preferred banks

- Accompanying clients to bank meetings

- Following up until account activation

With strong relationships across UAE banks including Emirates NBD, Mashreq, ADCB, and First Abu Dhabi Bank, EZ Bizz ensures faster account openings and better terms for clients.

10. License Renewal & Ongoing Compliance

Annual Renewal Process:

Meydan Free Zone licenses are valid for one year and must be renewed annually. The renewal process is straightforward and typically requires:

- Renewal application submission 30 days before expiry

- Payment of renewal fees

- Updated passport copies (if applicable)

Compliance Reminders:

EZ Bizz Corporate Services LLC provides ongoing compliance support, including renewal reminders, documentation updates, and regulatory change notifications. This proactive approach prevents license lapses and ensures uninterrupted business operations.

Corporate Tax & VAT Considerations (High-Level):

While Meydan Free Zone companies enjoy tax exemptions on corporate income, UAE introduced corporate tax regulations in 2023. Most free zone companies remain exempt if they meet qualifying conditions. Additionally, businesses exceeding the AED 375,000 revenue threshold must register for VAT. EZ Bizz provides guidance on tax compliance, VAT registration, and ongoing accounting support.

11. Common Mistakes to Avoid When Setting Up in Meydan Free Zone

Even with a streamlined process, entrepreneurs can make costly mistakes during Meydan Free Zone business setup. Here are pitfalls to avoid:

Wrong Activity Selection:

Selecting inappropriate business activities can lead to operational restrictions and additional licensing costs later. Work with EZ Bizz to conduct thorough activity planning and ensure your license covers all intended business operations.

Underestimating Visa Needs:

Many entrepreneurs underestimate their visa requirements and later face challenges hiring employees or relocating family members. Plan visa allocations carefully based on your team size and growth projections.

Ignoring Compliance Timelines:

Missing renewal deadlines or failing to update documentation can result in fines, license suspension, or visa cancellations. EZ Bizz Corporate Services LLC acts as a problem-preventing advisor, not just a service provider. Our proactive compliance monitoring ensures you never miss critical deadlines or regulatory changes.

12. Why Choose EZ Bizz Corporate Services LLC for Meydan Free Zone Setup

Navigating Meydan Free Zone company formation requires expertise, local knowledge, and reliable support. EZ Bizz Corporate Services LLC stands out as a trusted partner for Dubai free zone company setup:

Dubai-Based Licensed Consultancy:

EZ Bizz is a fully licensed business setup consultancy operating from Dubai with deep understanding of UAE regulations, free zone policies, and mainland incorporation procedures.

Experienced Business Setup Advisors:

Our team comprises seasoned consultants with hands-on experience in Meydan Free Zone business setup, visa processing, corporate banking, and compliance management. We’ve successfully assisted hundreds of entrepreneurs, startups, and international investors in establishing their UAE presence.

End-to-End Support (Setup → Visas → Banking → Compliance):

From initial consultation to ongoing compliance, EZ Bizz provides comprehensive support covering:

- Business activity selection and license type advisory

- Trade name reservation and approvals

- Documentation preparation and submission

- License issuance and visa processing

- Corporate bank account opening assistance

- VAT registration and corporate tax compliance

- Annual renewal and ongoing compliance management

Transparent Pricing:

We believe in transparent, upfront pricing with no hidden fees. Every cost component—from Meydan Free Zone license cost to government fees and service charges—is clearly outlined before you commit. This transparency builds trust and helps clients budget accurately.

Dedicated Client Support:

Every client is assigned a dedicated account manager who serves as a single point of contact throughout the setup process and beyond. Our responsive support team is available to answer questions, provide updates, and resolve issues promptly.

13. Frequently Asked Questions (FAQs)

Q1: How long does Meydan Free Zone company setup take?

The entire Meydan Free Zone company setup Dubai process, from initial application to license issuance, typically takes 2 to 5 business days for standard applications. Visa processing adds an additional 5 to 10 days. With EZ Bizz Corporate Services LLC managing your application, timelines are optimized for speed and efficiency.

Q2: What is the minimum cost for Meydan Free Zone company formation?

The minimum Meydan Free Zone license cost starts around AED 7,500 for a basic freelance license with virtual office package. Complete setup costs, including government fees, visa processing, and consultancy fees, typically range from AED 19,500 to AED 30,000 depending on your requirements.

Q3: Can foreigners own 100% of the company in Meydan Free Zone?

Yes, Meydan Free Zone company formation allows 100% foreign ownership without requiring a local sponsor or UAE national partner. This is one of the key advantages of Dubai Free Zones for international investors.

Q4: How many visas can I get with a Meydan Free Zone license?

Visa allocation depends on your office package and business activity. Basic packages typically include 1 to 3 visas. Meydan Free Zone visa quotas are flexible and can be increased by upgrading your office solution or demonstrating business growth.

Q5: Can I operate in mainland Dubai with a Meydan Free Zone license?

Meydan Free Zone companies are primarily authorized to operate within the free zone and conduct business internationally. However, with proper approvals and distribution agreements, you can conduct limited mainland activities. EZ Bizz can advise on the best structure for mainland access.

Q6: Do I need a physical office for Meydan Free Zone business setup?

No, physical office space is not mandatory for all license types. Meydan offers flexible solutions including virtual offices and flexi-desk packages, making it affordable for startups and solo entrepreneurs. However, certain activities may require dedicated office space.

Q7: How does EZ Bizz Corporate Services LLC help in the Meydan Free Zone setup process?

EZ Bizz provides end-to-end support including business activity consultation, trade name reservation, documentation preparation, license processing, visa applications, corporate bank account opening, and ongoing compliance management. Our experienced advisors ensure a smooth, hassle-free setup experience.

Q8: What are the renewal requirements for Meydan Free Zone licenses?

Licenses must be renewed annually. The renewal process requires timely submission of renewal applications, payment of fees, and updated documentation. EZ Bizz sends proactive reminders and manages the entire renewal process to prevent lapses.

Conclusion – Is Meydan Free Zone Right for Your Business?

Meydan Free Zone company setup Dubai offers a compelling combination of cost-effectiveness, operational flexibility, and investor-friendly policies. With 100% foreign ownership, zero taxes, fast incorporation timelines, and flexible visa options, it’s an ideal choice for entrepreneurs, startups, SMEs, and international investors.

Who Should Choose Meydan Free Zone:

- Solo entrepreneurs and freelancers seeking affordable business licensing

- Startups requiring fast, digital company formation

- E-commerce businesses and digital service providers

- Consultants, advisors, and professional service firms

- Trading companies and import/export operations

- International investors exploring UAE market entry

Whether you’re launching your first venture or expanding existing operations, understanding the Meydan Free Zone requirements, costs, and processes is essential for success. Partnering with an experienced consultancy like EZ Bizz Corporate Services LLC ensures you navigate regulations confidently, avoid costly mistakes, and establish a solid foundation for growth.

Ready to Start Your Dubai Business Journey?

Contact EZ Bizz Corporate Services LLC today for a free consultation. Our experienced advisors will assess your business needs, recommend the optimal setup structure, and guide you through every step of your Meydan Free Zone company formation. Let’s turn your entrepreneurial vision into reality in one of the world’s most dynamic business ecosystems.

With transparent pricing, dedicated support, and comprehensive end-to-end services, EZ Bizz is your trusted partner for Dubai free zone company setup success.

Book Free Consultation

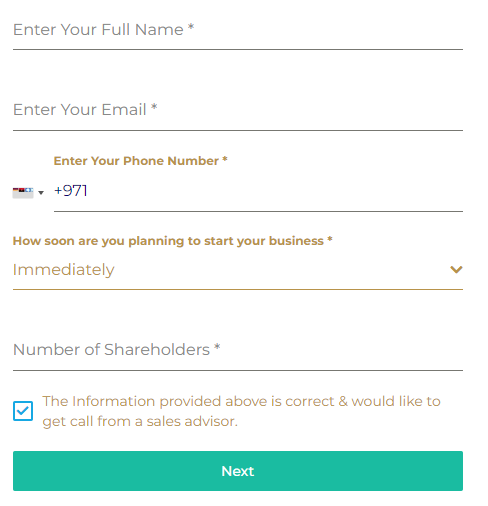

Calculate your business setup cost

Get an estimate for your desired business in your desired currency in under a minute with this cost calculator.

License types and activities:

A Mainland company formation offers more than 3000 business activities listed in the UAE. The business activity, company structure and jurisdiction of operation will determine the license and other applicable requirements.

For more details on business activities, reach out to us.

Operating with a Service License means you will run a business without any tangible assets, you focus more on selling unique services to your consumer (i.e. Consultancies, Project Management, Investment Services, etc.)

Selling goods within SHAMS or importing and exporting of goods. It includes movement of goods, wholesale and retail sale of goods and rendering of services related to the sale of these goods.

It allows for production, re-production, transformation and manufacturing of goods.

Popular Business Activities at DMCC:

- Commodities exchanges

- Business Support Firms

- Professional Services Companies

- Marketing Companies

- IT

- Logistics & Shipping Companies

- Banking & Finance

- Insurance

- Recruitment Agencies

- Food & Beverage Distributors