Mainland Business Setup in Dubai

About Mainland:

Starting a business in the UAE? Mainland Company Formation in Dubai is one of the most versatile and trusted ways to establish your presence in the region. Unlike free zone or offshore setups, a Dubai Mainland Company allows you to operate across the entire UAE market, engage in local trade, and build a strong commercial reputation with full regulatory backing.

Whether you’re an entrepreneur launching your first venture, an investor expanding into the Middle East, or an established business exploring new markets, understanding the Mainland Business Setup in Dubai process is essential. This guide will walk you through everything you need to know—from legal structures and licensing to costs, compliance, and why choosing the right business setup partner matters.

What Is a Mainland Company in Dubai?

A Mainland Company in Dubai is a business entity licensed and regulated by the Department of Economy and Tourism (DET Dubai). Unlike free zone companies that are restricted to operating within their designated zones (unless they appoint a local agent), mainland companies enjoy unrestricted access to the entire UAE market, including Dubai, Abu Dhabi, Sharjah, and beyond.

Key differences between mainland, free zone, and offshore:

- Mainland companies can trade directly with the local UAE market, participate in government tenders, and establish a physical presence anywhere in the country

- Free zone companies benefit from 0% corporate tax and full foreign ownership but face geographical restrictions without additional licensing

- Offshore companies cannot conduct business within the UAE and are used primarily for international trading, asset protection, and holding structures

Mainland Business Setup Services in Dubai

Navigating the Dubai Mainland Company Setup process requires expertise in UAE commercial law, licensing regulations, and government procedures. Professional business setup consultancies like EZ Bizz Corporate Services LLC provide comprehensive support including:

- Business activity selection and trade name approval

- Preparation and submission of all documentation

- Liaison with Department of Economy and Tourism (DET Dubai)

- Initial approval and final license issuance

- Office space solutions and Ejari registration

- Visa processing for shareholders, directors, and employees

- Corporate bank account opening assistance

- PRO services and government relations

- Ongoing compliance and renewal support

This end-to-end approach ensures your Mainland Company Registration in Dubai is completed efficiently, accurately, and in full compliance with UAE regulations.

Advantages:

- Freedom to rent commercial space in any area

- Ability to conduct a wide range of business activities

- Option to trade anywhere in the UAE and internationally

- 100% foreign ownership

- No currency restriction

- Easy employment visa processing

- Advantage of bidding on government projects

- Ability to open a corporate bank account easily

- Multiple business activities

Popular Licenses:

- Ecommerce

- Technical Services

- Salon

- Restaurent

- Digital Marketing

- Travel Agency

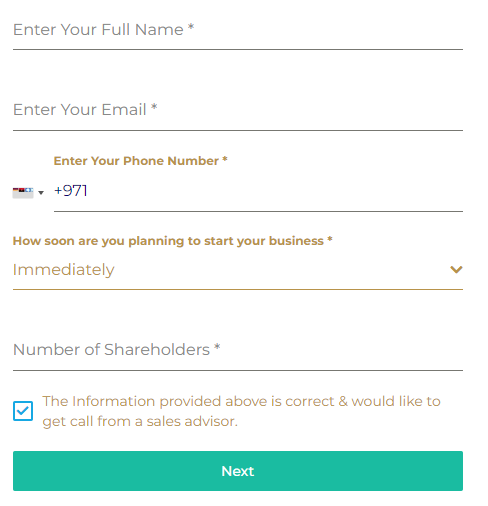

Book Free Consultation

Calculate your business setup cost

Get an estimate for your desired business in your desired currency in under a minute with this cost calculator.

License types and activities:

A Mainland company formation offers more than 3000 business activities listed in the UAE. The business activity, company structure and jurisdiction of operation will determine the license and other applicable requirements.

For more details on business activities, reach out to us.

A Commercial License is required in the UAE for businesses involved in trading and supplying of goods such as:

- Mobile phones & accessories trading

- Building material, cleaning and safety equipment trading

- Oil & gas, chemicals trading

- Automobiles, spare parts trading

- Gold & precious metals trading

An Industrial license is required in the UAE for manufacturing or other types of industrial activities such as:

- Garments, uniforms manufacturing

- Meat, dairy products manufacturing

- Animal & birds feed manufacturing, fishing net making

- Pastry & sweets manufacturing, mineral water bottling

- Fabrics & textiles embroidery, carpets manufacturing

A Professional License is required in the UAE for individuals or business groups that deliver expertise as a service to the public such as:

- Computer, IT infrastructure consultancies

- Insurance, tax, legal consultancies

- Marketing consultancies, public relations management

- Auditing & accounting

- Waste management & recycling consultancy

How to Choose the Right Legal Structure for a Dubai Mainland Company

Selecting the appropriate legal structure is critical for your Mainland Business Setup in Dubai. Here are the main options:

Limited Liability Company (LLC)

The LLC is the most popular structure for Dubai Mainland Company Setup. It allows up to 50 shareholders with limited liability protection. Foreign investors can now own 100% of an LLC in most business activities. It’s suitable for trading, services, consulting, and most commercial enterprises.

Sole Establishment

A Sole Establishment is owned by a single individual who bears unlimited liability. This structure is straightforward and commonly used by small business owners, freelancers, and professionals operating independently. 100% foreign ownership in Dubai mainland is permitted for sole establishments in approved activities.

Civil Company

A Civil Company is designed for professionals such as doctors, lawyers, engineers, architects, and consultants. It requires at least two partners practicing the same profession. This structure is governed by specific professional licensing requirements under DET Dubai.

Branch of a Foreign or UAE Company

Foreign companies can establish a branch office in Dubai mainland to extend their operations into the UAE. The branch operates under the parent company’s name and is typically used for representative or operational purposes. A UAE national service agent may be required for certain activities.

Public & Private Joint Stock Companies (PJSC / PrJSC)

Joint Stock Companies are suitable for large-scale enterprises requiring significant capital investment. A PJSC allows public shareholding, while a PrJSC is privately held. These structures involve more complex regulatory requirements and higher minimum capital thresholds.

How to Set Up a Mainland Company in Dubai (Step-by-Step)

The Mainland Company Formation Process in Dubai typically follows these steps:

Step 1: Select your business activities and determine the appropriate license type (commercial, professional, industrial, or tourism)

Step 2: Choose and reserve your company’s trade name through DET Dubai

Step 3: Draft your Memorandum of Association (MOA) and Articles of Association (AOA)

Step 4: Obtain initial approval from the Department of Economy and Tourism (DET Dubai)

Step 5: Secure office space with a valid tenancy contract (Ejari registration required)

Step 6: Obtain any external approvals from relevant authorities (health, education, media, etc.)

Step 7: Complete final license application and pay government fees

Step 8: Receive your Dubai Mainland Business License

Step 9: Apply for establishment card and immigration file

Step 10: Process investor and employee visas

Timeframe: The entire Mainland Company Registration in Dubai process typically takes 5 to 10 working days for straightforward activities, though businesses requiring external approvals may take longer.

Process of Mainland Company Formation in Dubai

The Mainland Business Setup in Dubai involves multiple approval stages:

Initial Approval Stage: Submit your business plan, shareholder details, and proposed activities to DET Dubai for preliminary review and approval.

External Approvals: Certain activities require additional licensing from specialized authorities such as Dubai Health Authority (DHA), Knowledge and Human Development Authority (KHDA), Dubai Municipality, or National Media Council.

Final License Issuance: Once all approvals are secured, office space is confirmed, and fees are paid, DET Dubai issues your final Mainland License Dubai.

Common delays to avoid:

- Incomplete or incorrect documentation

- Unclear or prohibited business activities

- Delays in securing compliant office space

- Missing external approvals

- Outstanding queries from regulatory authorities

Documents Required for Mainland Business Setup

To complete your Dubai Mainland Company Setup, prepare the following documents:

- Passport copies of all shareholders, directors, and general manager

- Visa copies and Emirates ID (if applicable)

- Passport-sized photographs with white background

- Initial approval certificate from DET Dubai

- Memorandum of Association (MOA) – drafted and notarized

- Tenancy contract (Ejari) for registered office space

- No Objection Certificate (NOC) from current sponsor (if applicable)

- External approvals (if required for specific activities)

- Business plan (for certain activities)

- Bank reference letters (occasionally requested)

Working with experienced consultants ensures all documents are correctly prepared, attested, and submitted.

Government Fees & Cost of Mainland Company Formation in Dubai

The Dubai Mainland Company Cost varies based on several factors:

- Business activity (commercial, professional, industrial, tourism)

- Number of activities included in the license

- Legal structure (LLC, sole establishment, branch, etc.)

- Office space location and size

- Number of visas required

- External approvals needed

Government fees for Mainland Company Formation in Dubai typically include:

- Trade name reservation fee

- Initial approval fee

- License issuance fee (varies by activity)

- Memorandum of Association notarization

- Chamber of Commerce membership

- Establishment card and immigration file fees

Additional costs include office rent, Ejari registration, visa processing, Emirates ID, medical tests, and consultancy fees. For an accurate quote tailored to your specific business, consult with Dubai business setup services providers.

Office Space & Ejari Requirement for Mainland Companies

All mainland companies must maintain a physical office space within Dubai. The office must be commercially zoned and registered with a valid Office Ejari for mainland company – the official tenancy registration system.

Important considerations:

- Visa quota is linked to office size (larger offices allow more employee visas)

- Flexi-desk and co-working spaces are acceptable for certain business activities

- Ejari registration is mandatory and must be renewed annually

- Office address appears on your UAE mainland license

Choosing the right office solution balances cost-efficiency with visa requirements and business credibility.

Corporate Tax & VAT for Mainland Companies in the UAE

Understanding tax obligations is essential for Mainland Business Setup in Dubai:

Corporate Tax for Mainland Companies: The UAE introduced a federal corporate tax of 9% on taxable profits exceeding AED 375,000, effective from June 2023. Businesses must register with the Federal Tax Authority (FTA), maintain proper accounting records, and file annual tax returns.

VAT Registration: Businesses with annual revenue exceeding AED 375,000 must register for 5% Value Added Tax (VAT). Voluntary registration is available for businesses with revenue between AED 187,500 and AED 375,000.

Compliance Importance: Proper tax registration, timely filing, and accurate record-keeping are mandatory. Non-compliance can result in penalties, fines, and reputational damage.

Why Choose EZ Bizz Corporate Services LLC

Setting up a Mainland Company in Dubai requires local expertise, regulatory knowledge, and government connections. EZ Bizz Corporate Services LLC offers:

Proven Experience: Years of successful Dubai Mainland Company Setup for clients across diverse industries

Complete Transparency: Clear pricing, no hidden fees, and honest timelines

Dedicated Consultant: Personalized support from a single point of contact throughout the process

Compliance Assurance: Expert guidance on DET Dubai regulations, licensing requirements, and ongoing obligations

Bank Account Assistance: Strong relationships with UAE banks to facilitate smooth Corporate bank account Dubai opening

Post-Setup Support: Visa renewals, license renewals, PRO services, accounting, and compliance management

We understand that every business is unique. Our tailored approach ensures your Mainland Company Registration in Dubai aligns with your goals, budget, and timeline.

Frequently Asked Questions About Mainland Company Formation in Dubai

Can foreign investors own 100% of a mainland company in Dubai?

Yes. Since the 2021 UAE Commercial Companies Law amendments, foreign investors can own 100% foreign ownership in Dubai mainland companies for most business activities, eliminating the previous requirement for a UAE national partner.

Do I need a local sponsor for a mainland company?

For most business activities, a local sponsor is no longer required. However, certain strategic sectors may still require UAE national participation. A local service agent may be needed for specific activities, but they do not hold equity.

What business activities are allowed under a mainland license?

Mainland License Dubai covers a wide range of activities including trading (import/export), retail, consulting, contracting, manufacturing, hospitality, real estate, professional services, and more. The Department of Economy and Tourism (DET Dubai) maintains a comprehensive list of approved activities.

Is office space mandatory for a mainland company?

Yes. All mainland companies must have a physical office with a valid Office Ejari for mainland company registration. Flexi-desk and co-working spaces are acceptable for certain business types.

Is corporate tax applicable to mainland companies?

Yes. Corporate tax for mainland companies is 9% on annual taxable profits exceeding AED 375,000. Proper registration with the Federal Tax Authority and compliance with filing requirements are mandatory.

Can I run a trading business with a mainland license?

Absolutely. Trading is one of the primary advantages of a Dubai Mainland Business License. You can import, export, and distribute goods throughout the UAE and internationally without restrictions.

How long does mainland company formation take?

Mainland Company Formation in Dubai typically takes 5 to 10 working days for standard activities. Businesses requiring external approvals from specialized authorities may take 2 to 4 weeks.

Can a mainland company open a corporate bank account in Dubai?

Yes. Corporate bank account Dubai opening is a standard step after license issuance. Banks require your trade license, MOA, passport copies, business plan, and proof of address. Professional assistance can streamline this process.

Ready to Start Your Mainland Company Formation in Dubai?

Establishing a Mainland Company in Dubai opens doors to unlimited business opportunities across the UAE and beyond. With 100% foreign ownership, full market access, and strong regulatory support from the Department of Economy and Tourism (DET Dubai), there’s never been a better time to launch your mainland business.

EZ Bizz Corporate Services LLC is your trusted partner for seamless, compliant, and cost-effective Dubai Mainland Company Setup. From initial consultation to license issuance, visa processing, and beyond, we handle every detail so you can focus on growing your business.

Contact EZ Bizz Corporate Services LLC today for a free consultation on Mainland Company Formation in Dubai. Let’s turn your business vision into reality.

Process for mainland license

- Choose business activity

- Choose company structure

- Get trade name approval

- Get initial license approval

- Get external approval (if required)

- License issuance

- Open company bank account

- Get establishment card

- Labour file

- Process visa