DMCC Free Zone Company Setup Dubai

About DMCC:

DMCC Free Zone Dubai – The Ultimate Destination for Business Setup and Trade

Starting a business in Dubai has become one of the most strategic decisions for entrepreneurs and international companies seeking growth in the Middle East, Africa, and Asia. Among the various free zones in the UAE, DMCC Free Zone stands out as a premier destination for business setup, offering world-class infrastructure, regulatory excellence, and unparalleled connectivity to global markets.

Whether you’re an investor looking to establish a trading company, a startup founder planning to launch a tech venture, or an established enterprise expanding into the region, understanding the complete process of DMCC free zone company setup Dubai is essential for making informed decisions. This comprehensive guide walks you through everything you need to know about DMCC company formation, from initial registration to ongoing compliance requirements.

What Is DMCC Free Zone and Where Is It Located?

The Dubai Multi Commodities Centre (DMCC) is a government-backed free zone authority established in 2002 with a clear mandate to facilitate commodity trade flows through Dubai. Located in the heart of Jumeirah Lakes Towers (JLT), one of Dubai’s most prestigious business districts, DMCC has transformed into a thriving ecosystem that supports over 23,000 companies from more than 170 countries.

DMCC’s strategic location offers businesses exceptional connectivity to Dubai Marina, Emirates Towers, and the broader Dubai business landscape. The free zone is home to the iconic Almas Tower, the world’s tallest diamond tower, and JLT’s distinctive cluster of modern commercial buildings that provide state-of-the-art office facilities.

What sets DMCC apart is its consistent recognition as the world’s number one free zone by the Financial Times’ fDi Magazine for nine consecutive years. This global reputation is backed by the Government of Dubai, ensuring regulatory stability, transparent processes, and a business-friendly environment that attracts multinational corporations and ambitious startups alike.

The free zone specializes in commodities trading while simultaneously supporting diverse sectors including technology, professional services, financial services, and creative industries. This versatility makes DMCC an attractive option for businesses across multiple industries seeking Dubai free zone company registration.

Why Start a Business in DMCC Free Zone Dubai?

DMCC offers compelling advantages that make it a preferred choice for international business setup. One hundred percent foreign ownership is guaranteed, meaning entrepreneurs maintain complete control of their companies without requiring a UAE national sponsor or partner. This ownership structure is particularly attractive for investors who want full autonomy over their business decisions and equity distribution.

The tax advantages in DMCC are substantial. Companies benefit from zero percent corporate tax on profits, zero percent personal income tax, and zero percent customs duties on imports and exports. While the UAE has introduced corporate tax regulations, free zone companies maintaining proper substance and conducting qualifying activities continue to enjoy favorable tax treatment under qualifying free zone person status.

DMCC’s international reputation significantly enhances business credibility. Operating from a globally recognized free zone provides instant legitimacy when dealing with international clients, suppliers, and financial institutions. This credibility advantage often translates into better business opportunities, easier access to funding, and stronger partnership possibilities.

The free zone offers unrestricted repatriation of capital and profits, allowing businesses to transfer funds internationally without restrictions. This financial flexibility is crucial for companies with global operations or international investors requiring regular distributions.

Access to DMCC’s extensive network represents another significant benefit. The free zone actively facilitates business connections through networking events, industry conferences, and partnership programs. Companies gain access to potential clients, suppliers, and collaborators within a concentrated business community.

Advantages of DMCC license:

- Ideal for the trading of precious metal, gems and diamond

- DDE Vault - world renowned secure diamond vault for storage

- Flexi-desk up X visa for service activities

- Wide range of office locations and types

- Located in the heart of Dubai with easy access to public transportation

- 100% exemption from corporate and income taxes

- A comprehensive range of business activities

- Zero foreign currency restrictions

- 100% business ownership and capital repatriation

- Online portal for services

Types of Companies You Can Register in DMCC Free Zone

DMCC company formation offers several corporate structures tailored to different business needs. The Free Zone Limited Liability Company (FZ-LLC) is the most common structure, providing limited liability protection to shareholders while allowing flexible ownership arrangements.

Single shareholder companies are permitted, meaning solo entrepreneurs can establish businesses without requiring additional partners. This structure is ideal for consultants, freelancers, and small business owners seeking individual control.

Multi-shareholder structures accommodate partnerships and investor groups, with shareholding percentages distributed according to agreements between parties. There are no restrictions on nationality for shareholders, enabling truly international ownership compositions.

Branch office registration is available for existing foreign companies wanting to establish presence in Dubai without creating a separate legal entity. Branches operate under the parent company’s legal framework while enjoying DMCC’s free zone benefits.

Holding company structures can be established for investment purposes, intellectual property management, or group company coordination. These entities facilitate tax-efficient corporate structures for businesses with multiple operational entities.

Corporate shareholding is fully supported, allowing companies to be owned by other corporate entities. This flexibility enables complex group structures, private equity investments, and institutional ownership arrangements.

DMCC Free Zone Company Setup Cost in Dubai

Understanding the cost structure for DMCC free zone company setup is crucial for proper business planning. While exact prices vary based on specific requirements, office choices, and additional services, businesses should budget for several key expense categories.

License fees represent the primary cost component, varying based on business activity and license type. Trading licenses typically command higher fees than service licenses, reflecting the commercial nature of trading activities.

Office space costs depend heavily on the selected option. Flexi-desk packages start at the lower end, providing cost-effective entry points for startups and solo entrepreneurs. Serviced offices offer fully furnished solutions at mid-range prices, while private fitted offices command premium rates reflecting their exclusivity and space.

Registration fees cover administrative processing, government approvals, and documentation. These fees are relatively standardized but may vary based on shareholding complexity and business structure.

Visa costs accumulate based on the number of employees, shareholders, and dependents requiring sponsorship. Each visa involves medical testing, Emirates ID processing, and immigration fees that must be factored into budgets.

Additional expenses include business setup consultant fees for companies engaging professional support, bank account opening facilitation charges, initial trade name registration, and memorandum of association drafting.

Companies should budget between AED 40,000 to AED 60,000 for basic setup with flexi-desk arrangements, while comprehensive packages with serviced offices and multiple visas may range from AED 50,000 to AED 150,000 or more depending on specifications.

Step-by-Step Process to Set Up a Company in DMCC Free Zone

Step 1: Select Business Activities and License Type – Determine your primary and secondary business activities, then identify the appropriate license category that covers your intended operations.

Step 2: Choose Trade Name – Select a unique company name that complies with DMCC naming conventions, avoiding restricted words and ensuring availability through preliminary name checks.

Step 3: Determine Shareholding Structure – Define ownership percentages, identify shareholders, and establish management roles including directors and authorized signatories.

Step 4: Select Office Solution – Choose between flexi-desk, serviced office, or fitted office based on your budget, visa requirements, and operational needs.

Step 5: Submit Application and Documentation – Complete online registration forms and submit required documents including passport copies, business plans, and corporate documents for corporate shareholders.

Step 6: Receive Initial Approval – DMCC reviews applications and issues initial approval, typically within a few business days for straightforward applications.

Step 7: Execute Lease Agreement – Sign the office tenancy agreement and pay associated rental deposits and fees.

Step 8: Pay License Fees – Complete payment for license fees, registration charges, and initial setup costs.

Step 9: Receive License and Establishment Card – Upon payment verification and document approval, DMCC issues the trade license and establishment card.

Step 10: Apply for Visas – Submit visa applications for shareholders, employees, and dependents, including medical testing and Emirates ID processing.

Step 11: Open Corporate Bank Account – Approach UAE banks with company documents to establish business banking facilities.

Step 12: Complete Final Setup Requirements – Obtain company seals, register with relevant authorities as needed, and complete any industry-specific registrations.

Documents Required for DMCC Company Formation

For individual shareholders, you’ll need valid passport copies showing biographical pages and UAE visa pages, recent passport-sized photographs with white backgrounds, and comprehensive curriculum vitae or professional resumes demonstrating relevant experience.

If shareholders hold UAE residence visas, copies of current Emirates ID cards must be provided. For individuals residing outside the UAE, additional proof of address documentation may be requested.

Corporate shareholders require significantly more documentation. Certified copies of commercial registration certificates, memorandum and articles of association, certificate of incumbency showing current directors, and certificate of good standing are essential.

Ultimate beneficial owner information must be disclosed, requiring passport copies and background information for individuals holding twenty-five percent or more ownership in corporate shareholders.

Business plan documents outlining company objectives, target markets, operational strategies, and financial projections support the application, particularly for activities requiring additional scrutiny.

Bank reference letters demonstrating financial standing may be requested, particularly for trading companies or businesses with significant planned operations.

Authorization letters and power of attorney documents are necessary if using consultants or third-party representatives to complete registration processes.

All documents in languages other than English require certified translation, and many documents require attestation or notarization depending on their origin country.

Approximate Processing Time:

Pre-approval: 7-10 business days

License: 2-3 business days

Establishment card: Same day as license

Visa application process: 7 business days

E-channel: 24 hours

The timeline for DMCC free zone company setup typically ranges from two to four weeks for straightforward applications with complete documentation. This timeframe covers registration, license issuance, and initial visa processing.

Initial application review and approval usually takes three to five business days once all documents are submitted correctly. DMCC’s digital systems expedite processing compared to traditional paper-based approaches.

License issuance follows quickly after approval and payment, often within one to two business days. Electronic licenses are generated promptly, though physical documents may take slightly longer.

Office handover timelines vary based on chosen solutions. Flexi-desk access can be immediate, serviced offices may be available within days, while fitted office customization could extend timelines by several weeks.

Visa processing represents the most variable timeline component. Basic employment visa processing takes seven to fourteen days, but banking delays, medical center appointments, and Emirates ID processing can extend this to three to four weeks.

Corporate bank account opening exists outside the direct setup timeline but critically affects operational readiness. Banking processes may take anywhere from two weeks to three months depending on bank requirements, business complexity, and documentation completeness.

Factors that may extend timelines include incomplete documentation requiring resubmission, complex shareholding structures requiring additional verification, activities requiring special approvals, and peak application periods during certain times of year.

Expedited processing options may be available through certain consultants who maintain established relationships with DMCC processing teams, though such services typically command premium fees.

DMCC Office Options – Flexi Desk, Serviced Office & Physical Office

Flexi-desk packages provide cost-effective entry into DMCC, offering shared workspace access with basic amenities. These solutions typically support limited visa quotas, usually accommodating one to three visas depending on specific packages.

Flexi-desk arrangements include access to professional business addresses for company registration, mail handling services, and shared meeting room facilities on a booking basis. This option suits consultants, freelancers, and small teams with minimal physical space requirements.

Serviced offices offer dedicated private office space with furniture, internet connectivity, and utilities included in rental packages. These turnkey solutions eliminate setup hassles and provide immediate operational capability.

Serviced office benefits include flexible lease terms, professional reception services, access to conference facilities, and significantly higher visa quotas ranging from five to fifteen depending on office size. These spaces accommodate growing teams requiring privacy and dedicated workspace.

Fitted offices represent premium solutions with customizable layouts, exclusive spaces, and the highest visa allocations. Companies can design interiors according to brand requirements and operational needs.

Physical office requirements apply to all DMCC companies regardless of business nature. Even businesses operating primarily remotely or internationally must maintain approved office space to remain compliant with free zone regulations.

Visa quota allocation directly correlates with office size and category. Larger offices support more employee visas, creating a direct relationship between physical space investment and team expansion capacity.

DMCC Visa Quota and Immigration Rules

DMCC visa allocation depends on office category and size. Flexi-desk packages typically provide one to three visa quotas, serviced offices offer five to fifteen quotas, and fitted offices provide allocations based on square footage calculations.

Shareholder visas are generally guaranteed regardless of office type, ensuring company owners can obtain residence visas. Investor visas follow similar principles, providing residence rights to qualifying shareholders.

Employee visas consume the available quota, requiring companies to carefully plan hiring against allocated visa capacity. Exceeding quota requires office upgrades or alternative employment arrangements.

Family sponsorship becomes available once individuals hold valid DMCC employment or investor visas. Spouses and children can be sponsored through standard family visa processes administered through immigration authorities.

Visa validity typically spans two or three years depending on processing type and preferences, with golden visa eligibility available for qualifying investors and professionals meeting specific criteria.

Visa cancellation requirements apply when employees leave companies. Proper cancellation procedures must be followed to avoid penalties and ensure compliance with immigration regulations.

Domestic helper visas can often be processed through DMCC sponsorship, allowing families to sponsor household employees under their residence visa quota.

DMCC Corporate Bank Account Opening

Opening a corporate bank account represents one of the most challenging aspects of DMCC company formation in the current regulatory environment. UAE banks apply rigorous due diligence requirements, reflecting international compliance standards and anti-money laundering regulations.

Major UAE banks serving DMCC companies include Emirates NBD, Mashreq Bank, Commercial Bank of Dubai, and Abu Dhabi Commercial Bank. Each institution maintains specific requirements and approval criteria.

Documentation requirements typically include company trade license, memorandum of association, certificate of incumbency, shareholder passport copies, UAE residence visa copies, business plan, proof of address for shareholders, and bank reference letters from existing banks.

Physical presence requirements mean shareholders and authorized signatories must attend bank meetings in person. Remote account opening remains extremely limited, requiring physical presence in the UAE.

Initial deposit requirements vary by bank and business type, ranging from minimal amounts for basic accounts to substantial deposits for trading companies or businesses in regulated sectors.

Processing timelines have extended significantly in recent years. While some straightforward applications complete within two weeks, complex business structures or higher-risk activities may face two to three months of processing time.

Banking challenges frequently arise from unclear business models, complex ownership structures involving multiple jurisdictions, insufficient documentation of business substance, and activities that banks perceive as high-risk.

Alternative banking solutions including digital banks and international banking options may be explored, though these come with their own requirements and limitations for UAE-based operations.

Annual Compliance, License Renewal & Audit Requirements in DMCC

DMCC License Renewal Process

Annual license renewal is mandatory for all DMCC companies. The renewal process typically begins sixty days before license expiry, with DMCC notifying companies of approaching deadlines.

Renewal requirements include settling any outstanding payments, renewing office lease agreements, maintaining minimum shareholder and director requirements, and submitting updated corporate information if changes occurred during the year.

Renewal fees approximate initial license fees, though discounts may apply for early renewal or long-term commitments. Office rental renewals occur simultaneously, often with annual rate adjustments based on market conditions.

Late renewal penalties apply to companies missing expiry deadlines, creating additional costs and potential operational disruptions. Planning renewal at least thirty days before expiry ensures smooth continuation.

Mandatory Annual Audit for DMCC Companies

DMCC companies must conduct annual financial audits performed by approved auditors registered with DMCC. This requirement ensures financial transparency and regulatory compliance.

Audit scope covers financial statements, accounting records, and compliance with UAE accounting standards. Auditors issue audit reports that must be submitted to DMCC during renewal processes.

Audit costs vary based on company size, transaction volume, and complexity, typically ranging from AED 5,000 to AED 25,000 or more for larger organizations.

Corporate tax compliance has become increasingly important following UAE corporate tax introduction. While qualifying free zone companies may benefit from zero percent rates, proper substance requirements, documentation, and transfer pricing considerations must be addressed.

DMCC Free Zone Business Setup Packages

Professional business setup consultants typically offer tiered packages to accommodate different business needs and budgets. These packages streamline the formation process and provide comprehensive support.

Starter Package typically includes trade license processing, initial trade name approval, basic business activity registration, memorandum of association preparation, flexi-desk office solution for one year, initial approval processing, and one investor visa processing. This entry-level package suits solo entrepreneurs and small startups with limited budgets.

Growth Package generally encompasses everything in the starter package plus serviced office solution accommodating small teams, three to five employee visa processing, bank account opening support, Emirates ID processing assistance, and one year of registered agent services. This mid-tier option serves growing businesses with small teams.

Premium Package provides comprehensive support including fitted office solutions, higher visa quotas supporting larger teams, dedicated account management, compliance support for the first year, PRO services for government processing, comprehensive banking facilitation, and priority processing where available. This option suits established companies and well-funded ventures.

Customized packages can be developed for unique requirements, combining elements from different tiers or adding specialized services like trademark registration, VAT registration, or industry-specific licensing support.

DMCC vs Other Dubai Free Zones

Comparing DMCC with other Dubai free zones helps businesses make informed location decisions. DMCC’s premium positioning contrasts with cost-focused alternatives like IFZA Free Zone or Meydan Free Zone.

IFZA offers significantly lower setup costs and annual fees, making it attractive for budget-conscious entrepreneurs. However, IFZA lacks DMCC’s prestige, location advantages, and established business community.

Meydan Free Zone provides competitive pricing and flexible packages with good visa allocations. Its location near Dubai’s business districts is advantageous, though it doesn’t match JLT’s centrality or DMCC’s international reputation.

Dubai South targets logistics, aviation, and industrial businesses with specialized infrastructure. Its airport proximity suits distribution companies, though its distance from Dubai’s commercial core may disadvantage service businesses.

Dubai Internet City and Dubai Media City cater to specific technology and creative industries with tailored ecosystems and networking opportunities. These zones suit companies in their target sectors but offer less flexibility for diverse business types.

DMCC’s advantages include superior international recognition, proven track record across multiple industries, prime JLT location, and strong governmental backing. These benefits justify higher costs for businesses prioritizing credibility and positioning.

Frequently Asked Questions About DMCC Free Zone Company Setup

Can I operate an e-commerce business from DMCC? Yes, DMCC supports e-commerce activities under appropriate license categories. Companies can conduct online retail, digital marketing, and platform-based businesses. However, selling to UAE mainland customers may require additional arrangements or mainland licensing.

How many visas does a DMCC company receive? Visa allocation depends on office type. Flexi-desk packages typically provide one to three visas, serviced offices offer five to fifteen visas, and fitted offices provide quotas based on square footage, potentially supporting dozens of employees.

Is corporate tax applicable to DMCC companies? UAE corporate tax applies to businesses, but qualifying free zone companies meeting substance requirements and conducting qualifying activities may benefit from zero percent tax rates. Professional tax advice ensures compliance with evolving regulations.

Can DMCC companies trade with mainland UAE? DMCC companies can trade with mainland UAE customers, but typically require local distribution partners or service agents. Some business activities allow direct mainland sales under specific conditions, though this varies by activity type.

What is the minimum capital requirement for DMCC company formation? DMCC does not impose minimum capital requirements for most business activities. Companies can establish operations without depositing significant share capital, though certain specialized activities may have capital expectations.

How long does DMCC company setup take? Standard setup timelines range from two to four weeks covering license issuance and initial visa processing. Banking processes may extend operational readiness by additional weeks or months depending on complexity.

Can I change my DMCC business activities after registration? Yes, business activities can be modified during annual renewal by adding or removing activities from your license. Some changes may require additional approvals or fee adjustments depending on activity categories.

Why Choose a Professional Consultant for DMCC Company Setup?

Engaging experienced business setup consultants significantly simplifies DMCC company formation while reducing risks and saving valuable time. Professional consultants bring specialized knowledge of DMCC procedures, documentation requirements, and regulatory nuances that non-specialists may overlook.

Expert guidance helps avoid common pitfalls including incomplete documentation, incorrect activity selection, inappropriate office choices, and compliance oversights that could delay approval or create future complications.

Time savings represent a major benefit. Consultants handle documentation preparation, government liaison, application submission, and follow-up processes, allowing entrepreneurs to focus on core business development rather than administrative procedures.

Established relationships with DMCC processing teams, banking institutions, and government departments enable consultants to expedite processes and navigate challenges more effectively than individual applicants.

Comprehensive service packages typically include pre-approval consulting, documentation preparation and review, application submission and tracking, visa processing coordination, banking facilitation, and ongoing compliance support.

Cost-effectiveness often surprises clients. While consultant fees represent additional expense, the value delivered through time savings, error prevention, and successful first-time approvals typically exceeds self-service approaches, particularly when opportunity costs are considered.

Risk mitigation through professional guidance protects against regulatory non-compliance, documentation errors, and strategic missteps that could compromise business operations or create legal complications.

Post-incorporation support ensures businesses maintain compliance with renewal requirements, audit obligations, and regulatory changes, providing peace of mind and operational continuity.

Ready to Start Your DMCC Free Zone Company in Dubai?

Establishing your business in DMCC Free Zone positions your company within one of the world’s most prestigious business communities, offering unparalleled access to Middle Eastern, African, and Asian markets. The combination of strategic location, regulatory excellence, tax advantages, and international credibility creates a compelling foundation for business success.

Whether you’re launching a trading enterprise, consulting practice, technology startup, or financial services firm, DMCC provides the infrastructure, support, and business environment necessary for sustainable growth. The free zone’s consistent recognition as the world’s leading free zone reflects its commitment to facilitating business success for companies of all sizes.

Taking the next step requires careful planning, proper documentation, and strategic decision-making around office selection, business structure, and operational requirements. Professional guidance throughout this journey ensures your DMCC company formation proceeds smoothly while positioning your business for long-term success.

Our experienced team specializes in DMCC free zone company setup Dubai, offering comprehensive support from initial consultation through license issuance, visa processing, and beyond. We understand the nuances of DMCC regulations, maintain strong relationships with authorities and banking institutions, and have successfully established hundreds of companies across diverse industries.

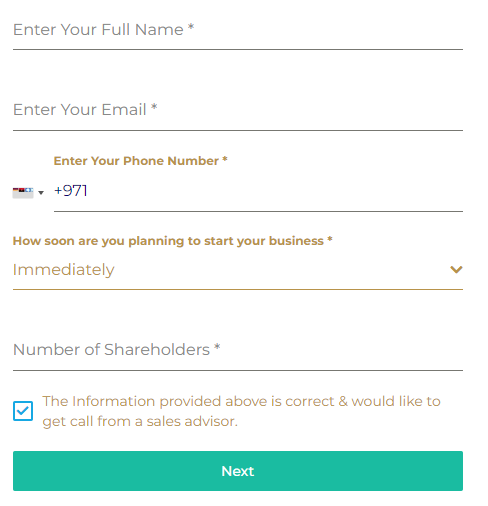

Contact us today for a personalized consultation about your DMCC business setup requirements. Our experts will assess your specific needs, recommend optimal structures, provide transparent cost estimates, and guide you through every step of the formation process.

Start your DMCC journey with confidence – reach out via WhatsApp, schedule a consultation call, or visit our office to discuss how we can help establish your business in one of Dubai’s most prestigious free zones. Your success story in DMCC begins with a single conversation.

Book Free Consultation

Calculate your business setup cost

Get an estimate for your desired business in your desired currency in under a minute with this cost calculator.

License types and activities:

A Mainland company formation offers more than 3000 business activities listed in the UAE. The business activity, company structure and jurisdiction of operation will determine the license and other applicable requirements.

For more details on business activities, reach out to us.

Operating with a Service License means you will run a business without any tangible assets, you focus more on selling unique services to your consumer (i.e. Consultancies, Project Management, Investment Services, etc.)

Selling goods within SHAMS or importing and exporting of goods. It includes movement of goods, wholesale and retail sale of goods and rendering of services related to the sale of these goods.

It allows for production, re-production, transformation and manufacturing of goods.

Popular Business Activities at DMCC:

- Commodities exchanges

- Business Support Firms

- Professional Services Companies

- Marketing Companies

- IT

- Logistics & Shipping Companies

- Banking & Finance

- Insurance

- Recruitment Agencies

- Food & Beverage Distributors