Free Zone Company Setup

About Freezone:

Free Zones are economic areas where one can carry out trade at preferential tax and customs rates. Free Zones were originally formed to boost international business in the region by offering benefits such as 100% foreign company ownership.

The UAE has over 50 free zones with some offering generic activities for all industries, whereas others are industry-specific.

Advantages:

- 100% Ownership

- No NOC (No Objection Certificate) is required from the current employer

- No paid-up share capital required

- Option to incorporate a company under common la

- Physical office space not mandatory

- 0% corporate and income tax

- Option to incorporate remotely

- Flexibility to incorporate in jurisdictions where employee health insurance is not mandatory

Popular Licenses:

- Ecommerce

- Technical Services

- Salon

- Restaurent

- Digital Marketing

- Travel Agency

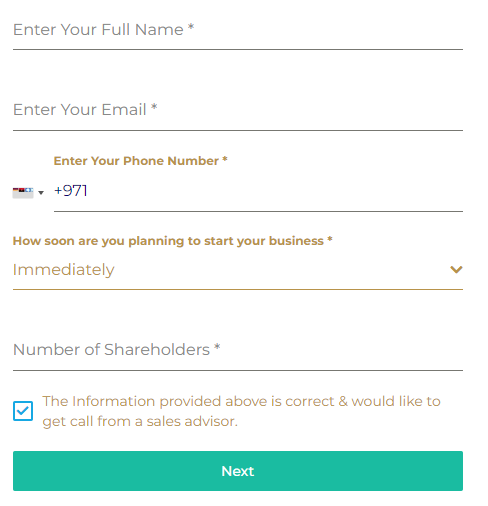

Book Free Consultation

UAE Freezone Areas:

- International Free Zone Authority (IFZA)

- Dubai Multi Commodities Center (DMCC)

- Dubai Airport Free Zone(DAFZA)

- Jebel Ali Free Zone (JAFZA)

- Dubai Silicon Oasis Authority (DSOA)

- Dubai International Financial Centre (DIFC)

- Meydan Free Zone (MFZ)

Calculate your business setup cost

Get an estimate for your desired business in your desired currency in under a minute with this cost calculator.

License types and activities:

A Mainland company formation offers more than 3000 business activities listed in the UAE. The business activity, company structure and jurisdiction of operation will determine the license and other applicable requirements.

For more details on business activities, reach out to us.

A Commercial License is required in the UAE for businesses involved in trading and supplying of goods such as:

- Mobile phones & accessories trading

- Building material, cleaning and safety equipment trading

- Oil & gas, chemicals trading

- Automobiles, spare parts trading

- Gold & precious metals trading

An Industrial license is required in the UAE for manufacturing or other types of industrial activities such as:

- Garments, uniforms manufacturing

- Meat, dairy products manufacturing

- Animal & birds feed manufacturing, fishing net making

- Pastry & sweets manufacturing, mineral water bottling

- Fabrics & textiles embroidery, carpets manufacturing

A Professional License is required in the UAE for individuals or business groups that deliver expertise as a service to the public such as:

- Computer, IT infrastructure consultancies

- Insurance, tax, legal consultancies

- Marketing consultancies, public relations management

- Auditing & accounting

- Waste management & recycling consultancy

Process for mainland license

- Choose business activity

- Finalize company name

- Complete incorporation paperwork

- License issuance

- Open company bank account

- Receive immigration card

- Process residence visa